In the states and a lot of western Europe there has been a rise in contactless payments and a decrease in cash usage. Between this and the fact that ATMs have started to have outrageous hidden charges people have lost faith in cash. However, there are still a lot of places in the world that still primarily take cash. For example if you end up staying in Croatia then you need cash for most places. But no matter where you go you should always take cash when travelling! Just be aware that Euronet is a scam.

How ATMs Scam People

There have been quite a few independent ATM companies that have come around with the rise of travelling and the golden age of cheap flights. A lot of these independent ATM companies will do multiple things to make money off of users.

The first thing that they do is almost completely unavoidable. That is a usage fee every time someone makes a withdrawal. These usage fees can be anywhere from $1.50 USD up to $10 or more depending on the company and where in the world you are. I believe there is only one way around these usage fees. Some banks, such as N26, don’t charge usage fees for ATMs. This means that you don’t have to pay that fee.

However, I may be wrong so I can’t promise anything. Yet I do get a notification everytime I use my N26 card in an ATM machine saying I wasn’t charged usage fees. Keep in mind most banks will add their own usage fees on top of the ATM usage fees.

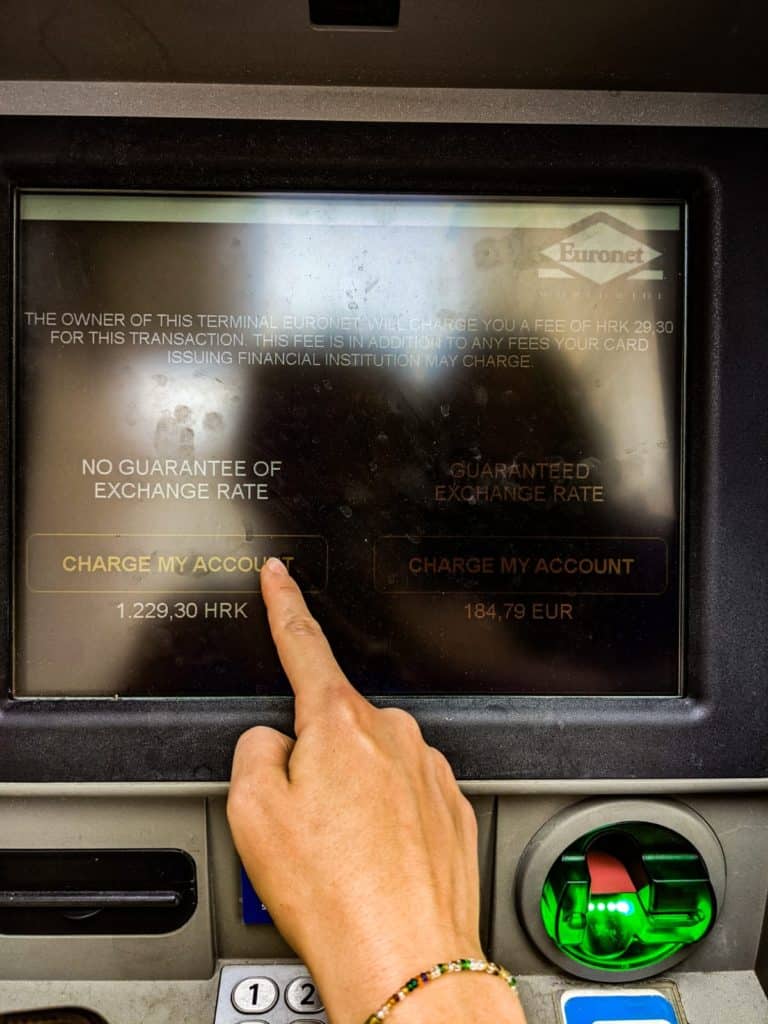

Always Select No Guaranteed Exchange Rate

The second thing I’ve noticed that’s an even bigger scam is the conversion fees. They word it like the fixed conversion rate is to do you a favour and it would be risky to not take it. Plus they add a huge markup on the conversions. Making the ability to take cash when travelling a real pain in the ass.

The other day Lisa and I pulled 1200 Kuna out of an ATM to test the difference. The fixed conversion wanted to charge us €184.79 Euros (~195 USD).

Instead of accepting the conversion rate they offered we decided to gamble with the “NO GUARANTEED EXCHANGE RATE”

Oh yes. Someone left their cap locks on. Almost as if they wanted to scare people or something. Weird right? But we were ready to risk it all!

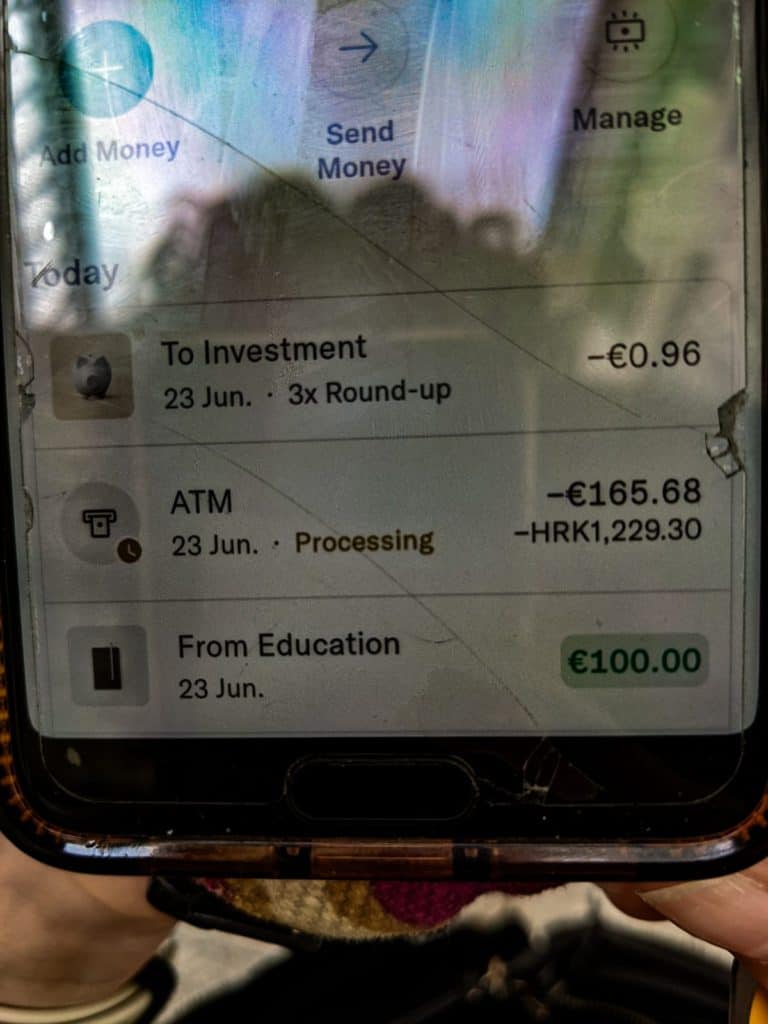

Immediately after pulling it out we checked our banking app to see what the actual conversion ended up being. €165.68 Euros (~175 USD). A 20 dollar difference! That’s fucking criminal if you ask me.

This also counts for debit machines. If they offer you to pay in local currency or your own, always select local currency.

Euronet Is The Worst.

If you’ve ever been to Europe then you’ve seen a Euronet ATM. They are everywhere. Throw a stone and it will probably hit a Euronet ATM. They are also the worst perpetrator of this. Huge hidden fees, disgusting fixed rates, asking “are you sure” like 17 times. Avoid Euronet like it’s a sugar filled pastry and you need to lose those last 5 pounds to fit into those pants. Euronet is a scam.

Another one that is pretty horrible is Auro Domus. Big circle with three horizontal bars in it; usually in yellow and black. Avoid these as well.

If You Can’t Use The ATMs That Are Everywhere What ATMs can you use?

Honestly that’s a surprisingly easy question to answer. If you’re going to take cash when travelling, and you absolutely should, then use official bank ATMs.

This means that whenever you go to a new country you should just do a quick search for what banks are prevalent in that area. Make a mental note of them and only use those. This will make your ATM experience so much better and make your choice to take cash when travelling far less anxiety inducing.

Keep in mind that this doesn’t count for ATMs that have both a Euronet and a bank logo. Euronet is a scam even then.

One Last ATM Scam To Be Aware Of.

This one is far less likely, but still happens. Sometimes scammers will put a card reader over top of the ATMs card reader. So when you put your card in to take out cash the scammers card reader also takes a scan and sends your information to the scammers device.

Avoiding this scam is actually supper easy. Whenever you go up to an ATM just give the card reader a good tug. If a scammer’s card reader is laid over top then it will pop off with that tug. Immediately take it to a nearby cop and tell them what happened. It’s very unlikely, but it does happen.

Would You Like A Receipt?

ATMs can be scary. The rates that they sometimes charge are nothing less than criminal. You just need to be smart when taking out cash. After all it is pretty important to take cash when travelling.

Stick to official bank ATMs as they are the safest bet. If you can’t do that then just make sure to avoid Euronet as Euronet is a scam. Whichever ATM you end up using make sure to give the card reader a good tug and never accept the fixed conversion.

Do those things and you should save a decent chunk of money.

Until next time stay authentic and stay nomadic.